Built-in HRAs combine traditional clinical coverage with an employer contribution towards worker professional medical expenses.

(ii) Any worker who has happy the work need of clause (i) and who's normally entitled to be involved in the approach commences participation no later on than the main working day of the first program calendar year starting after the day the work need was content Except if the employee was divided from company ahead of the very first day of that system yr.

Finally, employers must communicate the main points from the plan to staff so they are informed in their legal rights and tasks underneath the approach.

, apart from that Employee A makes use of only one week of paid out day off through the calendar year. Pursuant towards the cafeteria strategy, Staff A is deemed to own applied just one nonelective 7 days, and acquiring retained one particular nonelective week and just one elective 7 days of paid out day without work. Worker A receives in cash the worth from the unused elective paid out time off on December 31, 2009. Employer Q involves this total over the 2009 Kind W-2 for Staff A. Staff Essential report this volume as gross revenue in 2009.

A very compensated staff is undoubtedly an officer or shareholder possessing much more than five% of your voting electricity. If a person fulfills these descriptions, their spouse or dependents also are thought of highly compensated.

A participant in a very nondiscriminatory cafeteria strategy (like a extremely compensated participant or crucial employee) who elects skilled Added benefits is just not dealt with as acquiring obtained taxable Positive aspects available through the plan, and so the certified Gains elected by the worker aren't includible in the worker's gross income merely as a result of The supply of taxable benefits.

Staff that are enrolled in a bit 125 program can set aside insurance policy rates together with other funds pretax, which often can then go toward certain qualified clinical and childcare expenses. Dependant upon where they Reside, collaborating workforce can help save from twenty% to 40% in combined federal, point out, and local taxes on a number of items that they commonly by now buy with out-of-pocket post-tax cash. Companies can save an extra seven.sixty five% on their own share of payroll taxes.

This approach is not really a cafeteria prepare, since the prepare provides staff members no election concerning taxable and nontaxable Gains. The incident and well being coverage is excludible from workers' gross income. Case in point two.

. If an employer's incident or health plan masking the worker (or the worker's wife or husband or dependents) has copayments in unique dollar amounts, along with the greenback volume of the transaction at a health-related care company equals an actual a number of of not more than five occasions the dollar volume of the copayment for the specific provider (one example is, pharmacy advantage copayment, copayment for your health practitioner's Office environment visit) beneath the incident or well being strategy covering the precise staff-cardholder, then the cost is entirely substantiated without the need to have for submission of a receipt or more evaluation. (A) Tiered copayments

I conform to the privacy plan. By clicking “Submit” I conform to the Conditions & Problems and Privacy Coverage and agree to receive email messages and texts about promotions for the contact number and e mail offered, and have an understanding of this consent is just not expected to acquire.

It’s imperative that you note that a Section 125 Cafeteria Prepare won't offer overall health coverage. Rather, it will allow workers to use pre-tax funds to select and pay for the advantages they uncover beneficial, which can include things like overall health insurance policies among the Other individuals.

As an additional website edge, personnel receive an effective increase without any extra Price tag for the employer. More participants within the program equate to extra tax savings for your employer so the employer is usually inspired to lead to each staff's strategy to promote amplified participation by those who are not nonetheless within the Section a hundred twenty five program.

Confined Options – Not all companies provide all feasible Rewards programs which could depart many people caught with suboptimal possibilities.

. (i) Employer P's cafeteria plan gives the following Added benefits for employees that are covered by a person overall health insurance policies plan. The employee substantiates the bills for that premiums for your policy (as needed in paragraph (b)(2) in § 1.a hundred twenty five-6) ahead of any payments or reimbursements to the employee for premiums are made. The payments or reimbursements are made in the following techniques: (ii) The cafeteria system reimburses each worker specifically for the amount of the employee's substantiated wellness insurance quality; (iii) The cafeteria approach challenges the worker a Test payable into the wellbeing insurance company for the level of the worker's overall health insurance policy top quality, which the employee is obligated to tender to your insurance provider; (iv) The cafeteria strategy concerns a check in the exact same method as (iii), apart from the Verify is payable jointly to the employee and the insurance company; or (v) Under these situations, the individual health insurance coverage guidelines are incident and health designs as outlined in § one.106-1. This advantage is an experienced gain less than area 125.

Edward Furlong Then & Now!

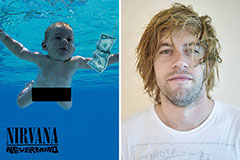

Edward Furlong Then & Now! Spencer Elden Then & Now!

Spencer Elden Then & Now! Devin Ratray Then & Now!

Devin Ratray Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Destiny’s Child Then & Now!

Destiny’s Child Then & Now!